About Us

Ritz Banc Group (RBG) is an experienced real estate, private equity and alternative asset management firm headquartered in Washington, D.C. RBG partners with investors and advises on the deployment of capital in the United States to diversify portfolios in real estate assets and preserve wealth.

At RBG, we collaborate to meet the vigorous needs of the world’s most refined high net worth family offices and institutional investors with a hands-on asset management approach:

Gain access to real estate opportunities sourced by the principals of RBG

Capitalize on assets with current yields and currency hedge

Invest through an internally managed tax efficient investment vehicle

Competitive Edge

- RBG sources investment opportunities in U.S. real estate based on internally developed investment criteria to maximize risk-adjusted returns

- Rather than offering exposure to a blind pool of assets through a fund vehicle, our approach offers personalized direct investment in individual real estate assets for our investors

- RBG co-invests in every deal, aligning interests with its partners and acting as a true “manager” rather than a “capital allocator”

- Investment criteria are tailored for each asset class; RBG develops investment strategies for multifamily, office, and industrial assets

- RBG partners with seasoned operators in each target market that provide deep submarket knowledge and maximize the value of its investments

- Individual investment identification is based on the return requirements of each investor (i.e., IRR-Driven vs. Cash-on-Cash Driven, Opportunistic vs. Core, etc.)

- RBG configures each transaction to maximize tax-efficiency for its investors and structures the deals to conform with its partner’s investment criteria, being sharia compliant or conventional

- RBG principals have managed the company since its founding in 2012 and will always remain engaged and accessible to their partners

Mission

Align interest with our investors through co-investments while building trust based on integrity and a passion to perform.

Offer a platform for investors to access different real estate markets while following a structured investment philosophy.

To be an active and compassionate member of the community.

Vision

Provide personalized approach to generate attractive risk adjusted returns to investors through portfolio diversification and capital preservation.

By the Numbers

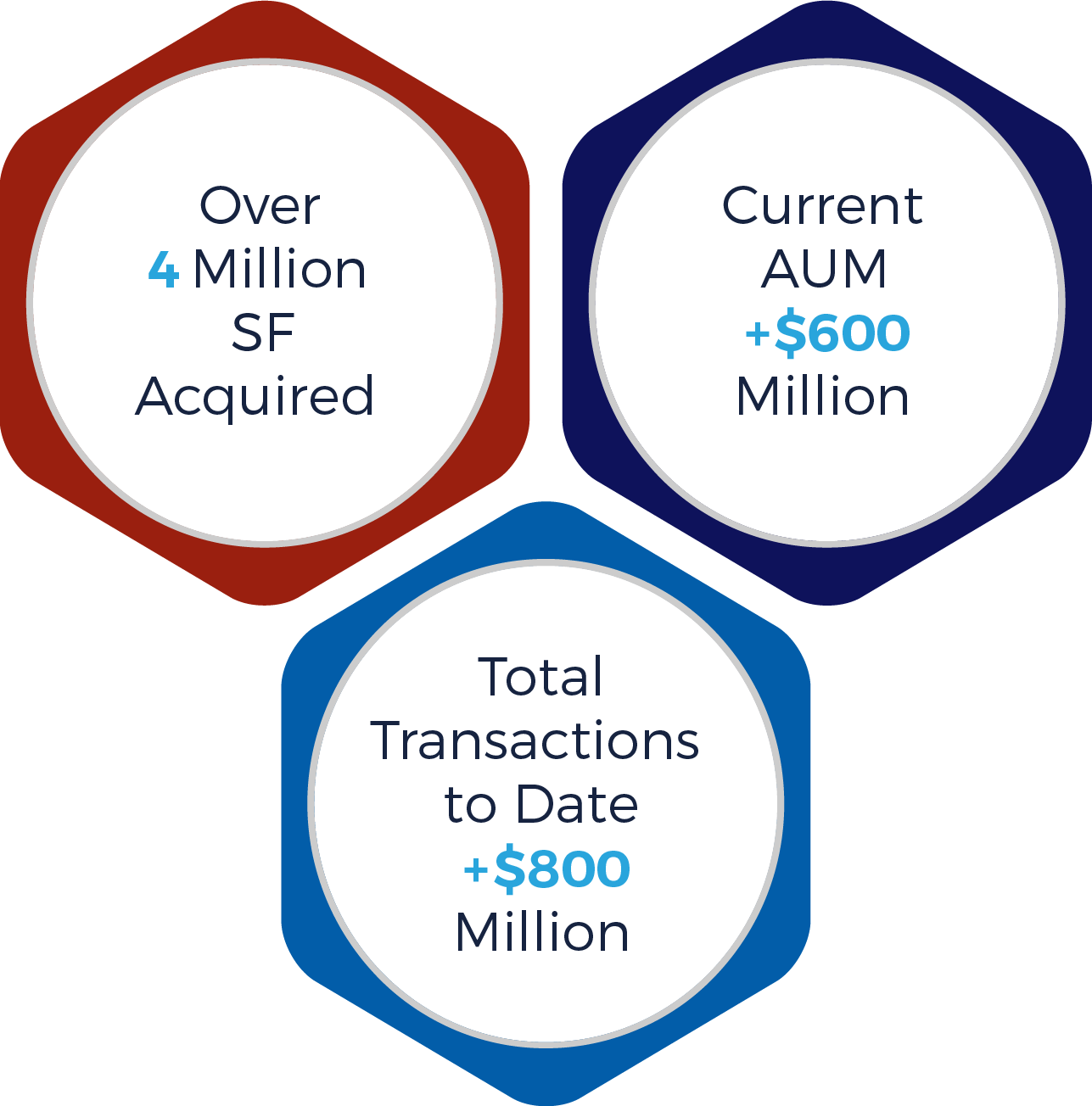

Since 2012, RBG has successfully acquired and managed more than $800 million worth of assets. The firm is a vertically integrated investment and property management platform that provides value creation, diversification and capital preservation for its limited partners through rigorous underwriting practices, deep market knowledge and relationships.

Our commitment is reflected in a firm culture that values professionalism, ethics, integrity and a passion to perform.